This article examines the current state of the top three semiconductor companies, Samsung Electronics, Intel and Taiwan Semiconductor, and discusses the future prospects for each company.

Currently, the semiconductor shortage in some parts of the world has not been resolved. However, the overall semiconductor market continues to decline. In particular, the memory market has seen a drop in unit price due to oversupply, which has had a significant impact on Samsung's profitability. Even TSMC, which increases sales every quarter, expects sales in the January-March 2023 quarter to be lower than in the October-December 2022 quarter. In addition to deteriorating market conditions, delays in shipping strategic products have become a serious problem for Intel. In this article, I want to analyze the current state of the top three semiconductor companies -- Samsung Electronics, Intel and Taiwan Semiconductor -- and discuss the future prospects for each.

Samsung Electronics' operating profit fell 70% in the second quarter

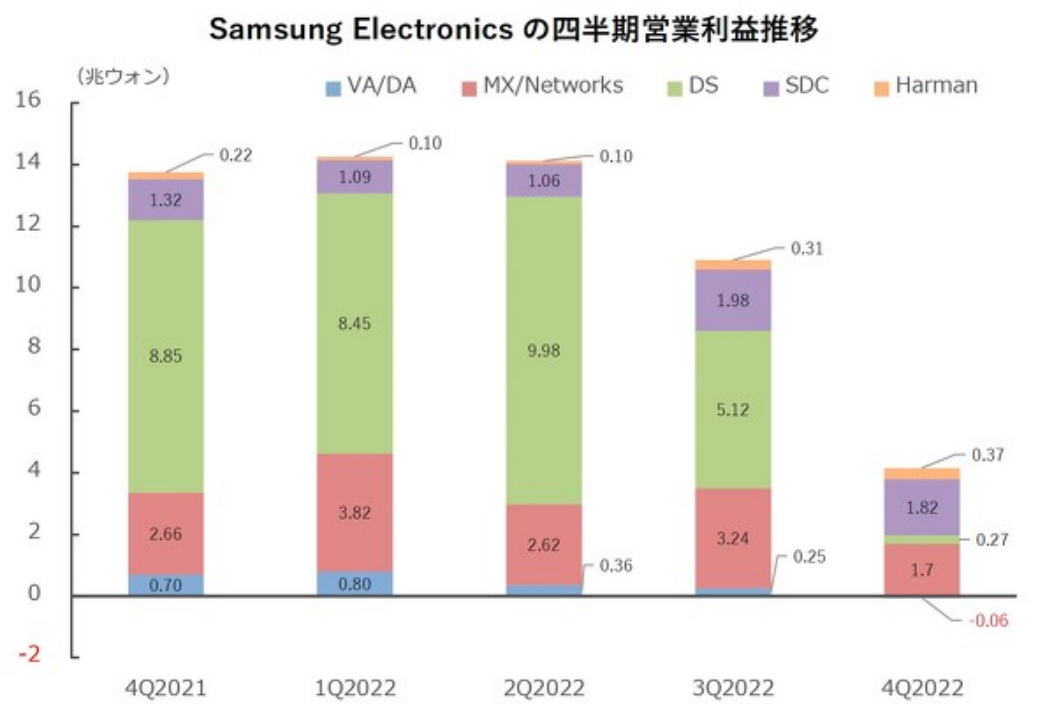

Figure 1: Samsung Electronics quarterly operating revenue trend

As an integrated electronics manufacturer, Samsung has a wide range of products, including the VA/DA division (consumer devices such as TVS), MX/Networks division (communications devices such as smartphones), DS division (semiconductors), SDC division (displays) and Harman (automotive equipment) business.

The operating profit of the DS division, the largest in terms of revenue, declined sharply. In the October-December period of 2022, the DS division recorded a minority operating profit, but managed to avoid a loss. Needless to say, this is due to the deterioration in the DRAM/NAND flash market and concerns that the January-March and April-June quarters of 2023 will be worse than the October-December quarters of 2022.

As can be seen from the figure, the recent performance of Samsung's DS business division has a great impact on the performance of the whole company. The DS division also includes wafer fabrication (contract manufacturing of semiconductors), but it is clear that the DS division's profits are tied to the state of the memory market.

Samsung is second only to TSMC in contract wafer manufacturing, but has less than half its sales and is estimated to have a wide margin.

Intel continues to lose money

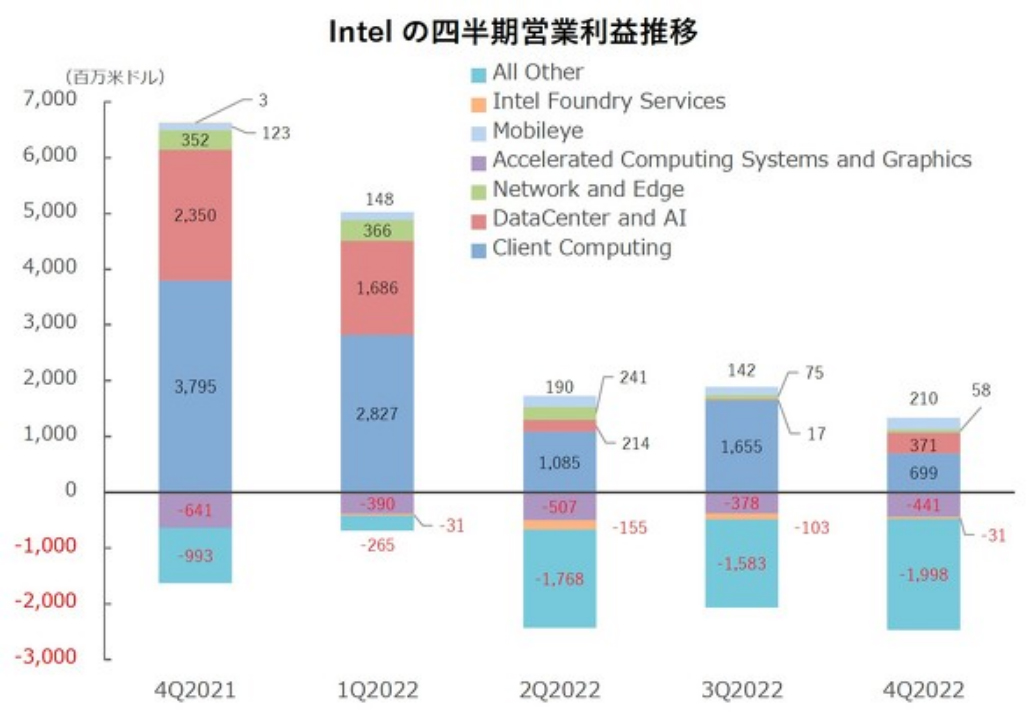

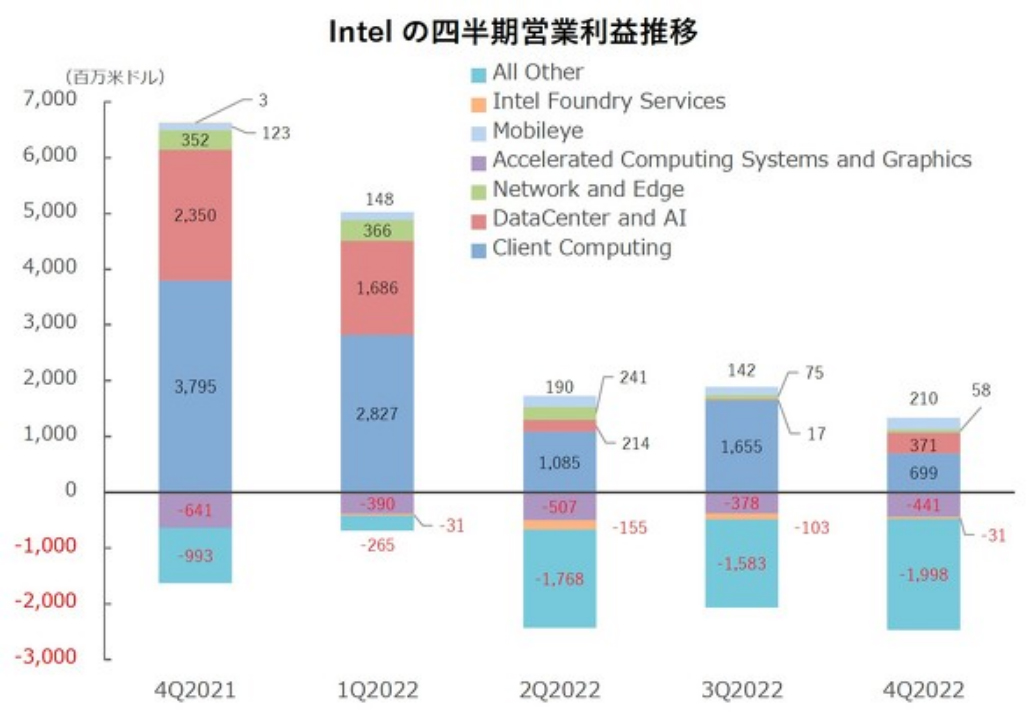

Figure 2: Intel's quarterly revenue shift

Figure 2 plots Intel's quarterly operating profit trends. Intel's performance has continued to deteriorate since the beginning of 2022. While it remained profitable in the January-March quarter of 2022, it has lost money for three consecutive quarters since the April-June quarter of 2022.

Intel's revenue centers are the client computing division (PCS) and the data center and Artificial intelligence division (servers/data centers). However, coupled with the market downturn, Intel's strategic products have not been brought to market as planned. In particular, Sapphire Rapids, a strategic server product, was scheduled to ship in the second half of 2021, but will not ship in 2022 until January 2023. I've heard of many cases where eager customers can't stand the delays and switch to competitors like AMD.

Intel, which wants to catch up, expects sales of about $11 billion in the January-March quarter of 2023, down from $14 billion in the October-December quarter of 2022. Intel once had more than $20 billion in quarterly revenue and can't expect to turn a profit on that revenue level, which means Intel's deficits are expected to continue.

TSMC's sales and profits have risen every quarter

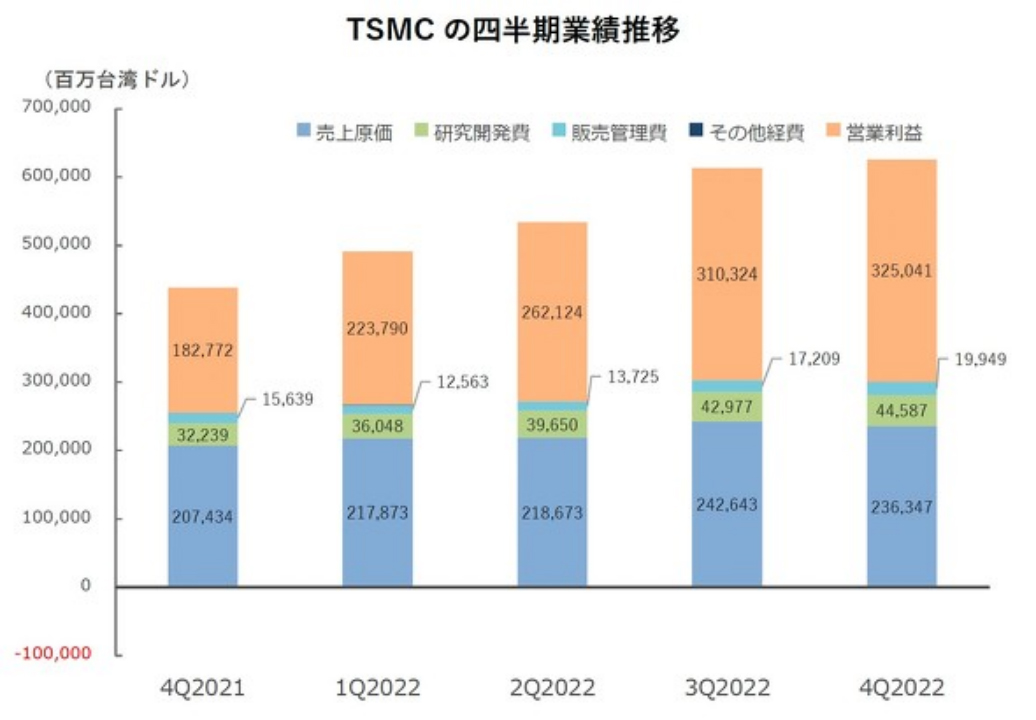

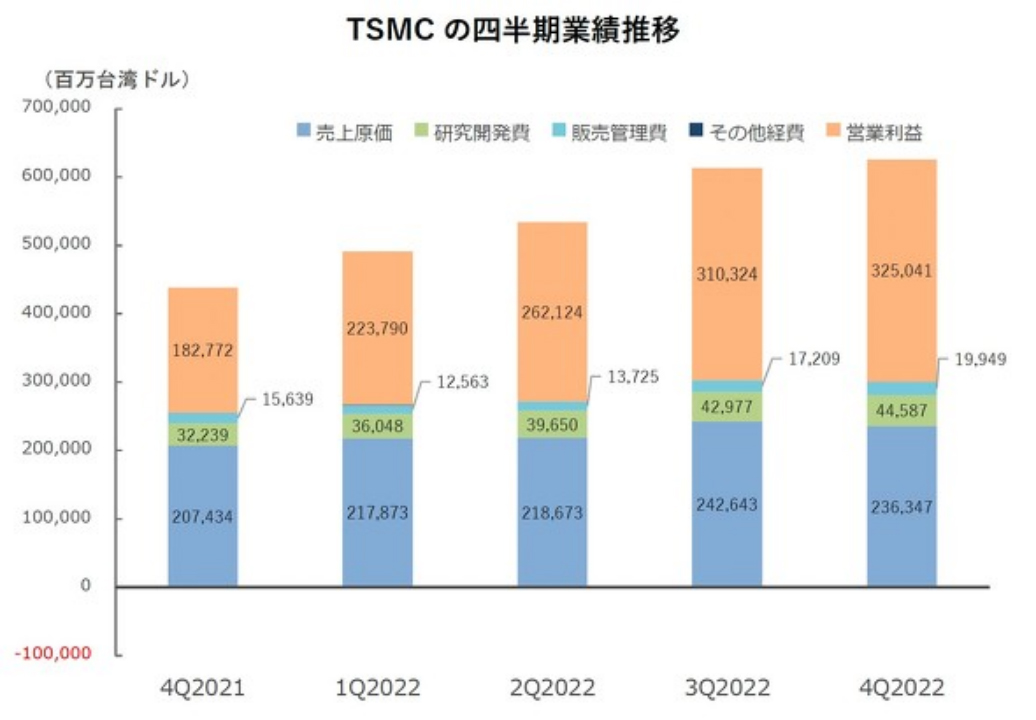

Figure 3: TSMC quarterly operating profit trend

Figure 3 shows the trend chart of TSMC's quarterly sales and operating profit. In contrast to the aforementioned Samsung and Intel, which have had to reduce revenues and profits due to the market downturn and delayed shipments of their products, TSMC has achieved quarterly revenue gains. And what's amazing is its profitability, with a gross margin of 62% and an operating margin of 52% in the October-December period of 2022. Unlike vertically integrated device makers (IDMs) such as Samsung and Intel, which both design and build their own semiconductor products, TSMC, which specialises in wafer fabrication, said "the results show we are the only winner in the industry".

These three semiconductor manufacturers are respectively leading in memory, MPUs, wafer foundry performance, each has its own characteristics. Samsung and Intel, two IDMs, also compete with TSMC in the wafer manufacturing business. In the past, it has lost customers to Samsung or Intel, but now it has an overwhelming lead over them in advanced processes. It can be said that the difference between Taiwan Semiconductor Manufacturing Co., LTD., which has mastered the most advanced EUV exposure equipment, and Samsung and Intel, which have not yet mastered it, lies in their achievements in advanced manufacturing process.

TSMC's 7nm and 5nm processes, which use EUV exposure equipment as a necessity, accounted for 54 percent of sales in the October-December 2022 quarter. ASML is the only equipment manufacturer that can supply EUV exposure equipment, but estimates that about 80 per cent of those shipments go to Taiwan Semiconductor Manufacturing Co.

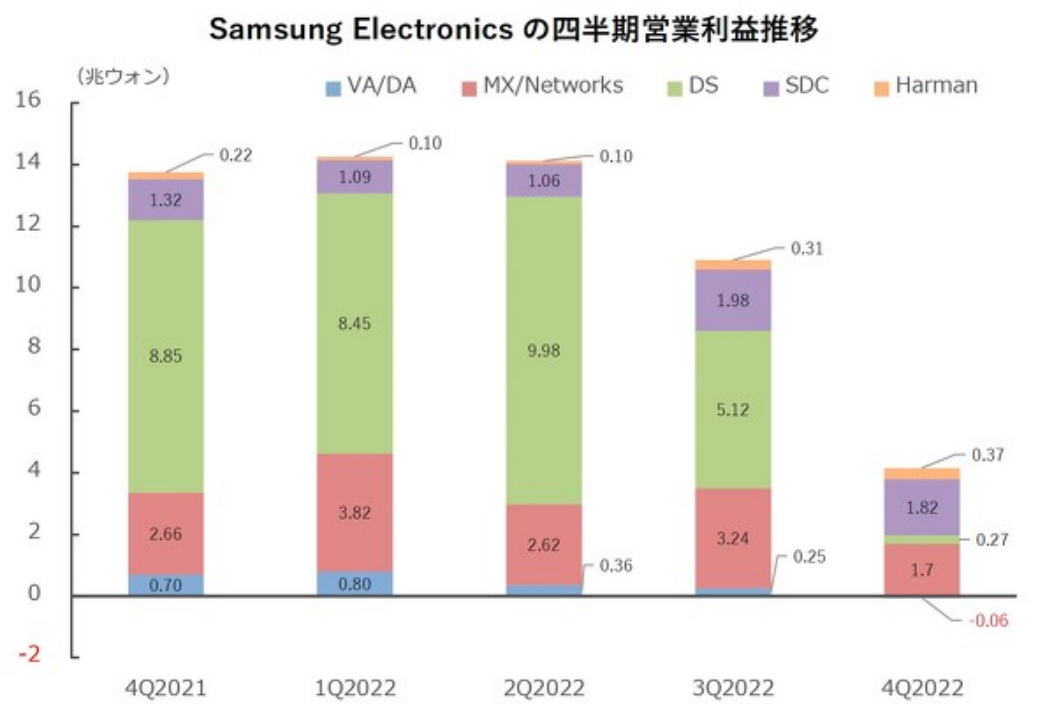

Figure 4: TSMC quarterly sales by application

Figure 4 shows TSMC's quarterly sales trends by application. Sales are focused on smartphones with high demand for advanced technology and high-performance computing (servers, processors, etc.). However, demand for all applications is sluggish, and it seems that TSMC's sales in January-March 2023 are expected to be lower than sales in October-December 2022.

Taiwan Semiconductor is likely to get more attention

The three major companies in the semiconductor industry have an annual capital investment of 3 trillion yen to 5 trillion yen, and they have acquired about half of the global semiconductor manufacturing equipment. However weak Samsung and Intel may be, they will not lose their spotlight as major players in the semiconductor industry. However, TSMC has never been so far down the road in terms of advanced process performance. And while TSMC has a reputation for being at the forefront, it is the mature manufacturing process that generates high profits.

Now that the importance of semiconductors is strongly recognised in industrial policies in various countries and regions, many are asking whether TSMC should stay where it is or be lured in. Both Japan and Europe are trying to entice TSMC to build plants by paying subsidies. The advantages of TSMC are not limited to advanced technology. Samsung and Intel are also invited to attend, but with relatively different names.

Heard that Taiwan Semiconductor invited Kumamoto things, opinions vary, not necessarily in favor of. However, it is certain that the semiconductor industry will become more and more important in the future. Successfully attracting the most centripetal Taiwan Semiconductor will drive the next development of the semiconductor industry in Japan.