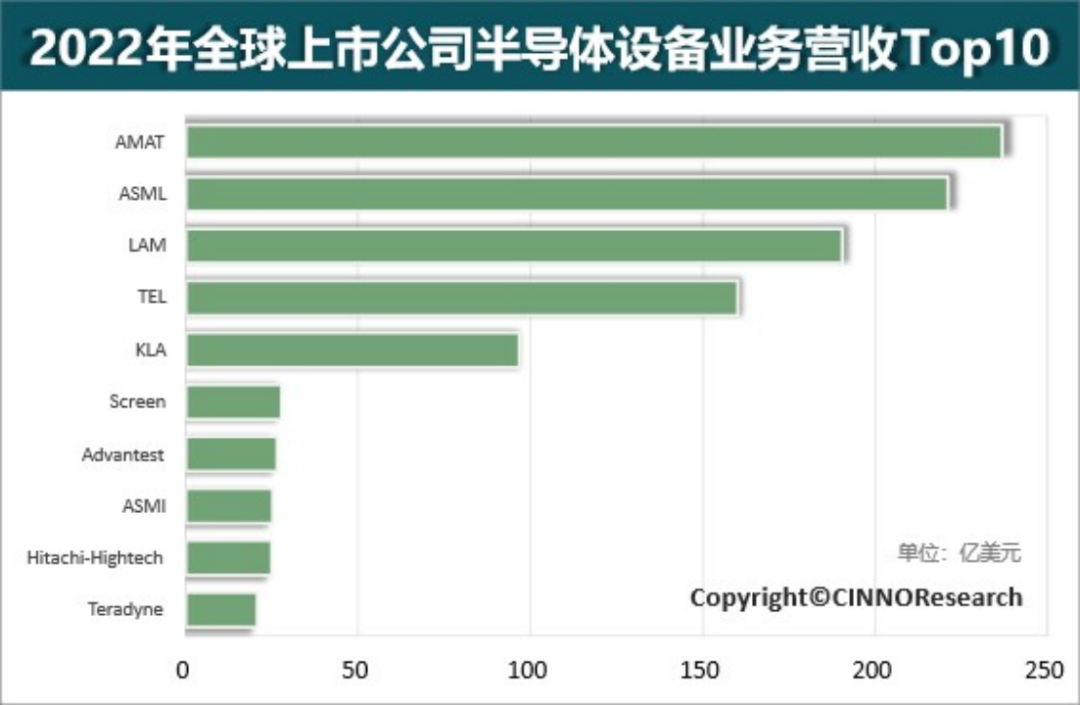

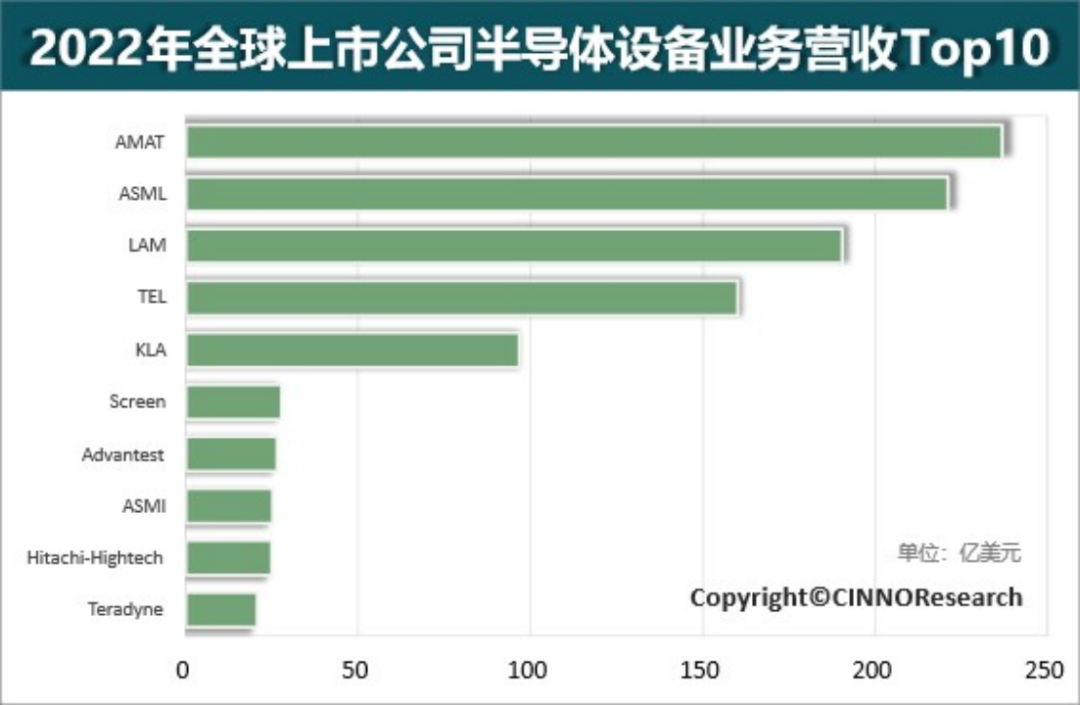

Recently, CINNO Research recently published a list of data, 2022 listed companies in the world's top 10 semiconductor equipment business revenue, the total revenue of 10 enterprises up to 103 billion dollars! The figure was the highest revenue recorded in nearly three years, up 6.1 percent from a year earlier.

No surprise, the top 10 manufacturers are the United States, Japan, Dutch.

Of these, the United States has four, Japan and the United States are equal at four, and the Netherlands has two.

Unfortunately, it is still difficult to see domestic semiconductor manufacturers in the list.

Data source:CINNO Research

(1) In 2021, 1 euro = $1.20 and 1 yen = $0.009, and in 2022, 1 euro = $1.05 and 1 yen = $0.007.

(2) This revenue ranking is based on the revenue of semiconductor business, excluding the revenue of FPD, PCB and other business.

The list is a change from last year, with Disco dropping off the list, Hitachi High-Tech entering and Teradyne dropping from No. 7 to No. 10.

The top spot is still held by AMAT of the US, with revenues of nearly $23.7bn last year; ASML was second; LAM ranked third; Tokyo Electron (TEL) was fourth; KLA was fifth. In other words, three of the top five are U.S. companies, which is a good indication of their strength in semiconductor equipment.

In terms of revenue, the semiconductor businesses of the top four players are each expected to generate more than $16 billion in revenue in 2022. Among them, the annual revenue of semiconductor business of KLA in 2022 is nearly $10 billion, with a year-on-year growth of 32.2%, which is the fastest growth among TOP10 equipment manufacturers.

Top 1 Applied Materials (AMAT) - USA

As the world's largest semiconductor equipment manufacturer and the "semiconductor equipment supermarket" in the industry, the semiconductor business can almost run through the entire semiconductor process. The semiconductor products include thin film deposition (CVD, PVD, etc.), ion implantation, etching, rapid heat treatment, chemical mechanical leveling (CMP), measurement and testing equipment. Semiconductor revenue grew 7.4 percent in 2022 from a year earlier.

Applied Materials Inc. reported results for its fiscal first quarter ended Jan. 29, 2023. Quarterly net sales were $6.739 billion, compared with $6.271 billion a year ago. Quarterly net income was $1.717 billion, compared with $1.792 billion a year earlier.

Top 2 ASML (ASML) - Netherlands

The world's largest photolithographic machine equipment manufacturer, but also the world's only can provide 7nm and below advanced process EUV photolithographic machine equipment manufacturer. Semiconductor revenue declined 1.2 percent in 2022 from a year earlier.

On March 8, 2023, citing "national security," the Dutch government announced that it would impose new export controls on certain semiconductor manufacturing equipment, including "state-of-the-art" deep ultraviolet lithography machines (DUVs).

On March 28, the Minister of Commerce Wang Wentao met with the global president of ASML of the Netherlands, Thomas Wennink. The visit attracted a lot of attention from the outside world and heralded a possible further strengthening of economic cooperation between China and the Netherlands. ASML, as the world's leading manufacturer of semiconductor equipment, is of great significance to the economic cooperation between China and the Netherlands. China is one of the world's largest semiconductor markets, while the Netherlands has strong technological advantages in the semiconductor field. Therefore, economic cooperation between China and the Netherlands has broad space and potential in the semiconductor field.

Top 3 Pan Forest (LAM) - USA

The company, also known as Lamm Research, specializes in etching equipment, thin-film deposition equipment and cleaning equipment for semiconductor manufacturing. It just announced plans to cut about 7 percent of its workforce to reduce expenses in a declining market. Tim Archer, the company's chief executive, said about 1,300 jobs would be cut worldwide. He expects the overall market for chip devices to fall to about $75 billion this year, down about $20 billion from last year.

The company said its chipmaker customers were slowing production lines, delaying construction of new plants and making fewer improvements to existing facilities. Electronics companies that buy chips are stockpiling unused components, which is rippling through the supply chain.

Top 4 Tokyo Electron (TEL) - Japan

Japan's largest semiconductor equipment manufacturer, the main business includes semiconductor and flat panel display manufacturing equipment, semiconductor products include coating imaging equipment, heat treatment equipment, dry etching equipment, chemical vapor deposition equipment, wet cleaning equipment and testing equipment.

TokyoElectron (TEL) announced that it will build a new semiconductor manufacturing facility in Ozhou, Iwate Prefecture, with a view to starting production in fall 2025. TEL is optimistic about the growth of semiconductor demand in the future, and plans to increase the capacity of the equipment to 1.5 times when the new plant is put into operation, and up to 2 times by improving production efficiency and other measures. The total investment of the project is expected to reach about 22 billion yen.

Top 5 Kolei (KLA) - USA

KLA-Tencor is deeply engaged in the semiconductor forward track inspection equipment industry. Currently, its products have covered all kinds of forward track optical and electron beam measurement equipment in the processing process. Its testing products have the characteristics of high efficiency and accuracy.

Top 6 Deans (Screen) - Japan

SCREEN focuses on the R&D and promotion of semiconductor manufacturing equipment, especially cleaning equipment. It has four main business directions: semiconductor manufacturing equipment, image information processing machines, LCD manufacturing equipment, printed circuit board equipment.

Top7 Advantest Test (Japan)

Aiwan is mainly engaged in the research and development, manufacturing, sales and service of large-scale integrated circuit automatic testing equipment and electronic measuring instruments. Products are mainly divided into integrated circuit automatic testing equipment and electronic measuring instruments two parts.

Product package SoC test system, Memory test system, mixed signal test system, LCD Driver test system, dynamic manipulator, etc. Electronic measuring instruments include spectrum analyzer, network analyzer and so on. Semiconductor revenue in 2022 grew 4.6 percent year on year.

Top 8 ASM International (ASMI) - Netherlands

The main business includes semiconductor forward deposition equipment, products including film deposition and diffusion oxidation equipment. Semiconductor revenue grew 21.5 percent year on year in 2022.

Top 9 Hitachi High-Tech (Japan)

Hitachi-High Technologies was formed by the merger of Hitachi Co., LTD. Instrument Group and Semiconductor Manufacturing Equipment Group with Nisei Sanyo Co., LTD. In semiconductor equipment, Hitachi High-tech mainly produces deposition, etching, testing equipment, as well as packaging and SMT equipment. Pro forma semiconductor revenue growth of 21.1 percent year over year in 2022.

Top 10 Teradyne - Beautiful

The main business can be divided into semiconductor testing, system testing, wireless testing and industrial automation. Semiconductor testing includes wafer level testing and device packaging testing. Semiconductor revenue in 2022 was down 21.3 percent year on year.

The market size of semiconductor equipment in China has grown significantly and has become the world's largest semiconductor equipment market. Data show that in 2021, China's semiconductor equipment market continued to grow, with the sales volume reaching 199,335 billion yuan, a year-on-year increase of 58.1%. China Business Research Institute predicts that the semiconductor equipment market will reach 303.2 billion yuan in 2023.

In recent years, the state has given encouragement and support to the semiconductor industry, but this industry is a technology-intensive industry, and it takes time to accumulate experience and technological innovation. Compared with foreign advanced manufacturers, the development history of our semiconductor industry is relatively short, and the talent and technical level of the existing semiconductor industry and its special equipment can not meet the industrial demand, which is one of the main reasons for the relatively weak research and development and manufacturing technology of semiconductor equipment. In the future, with the support of national policies and the continuous development of semiconductor industry, our semiconductor industry will gradually accumulate talents and products, and will be able to form strong competition with foreign first-class equipment manufacturers.