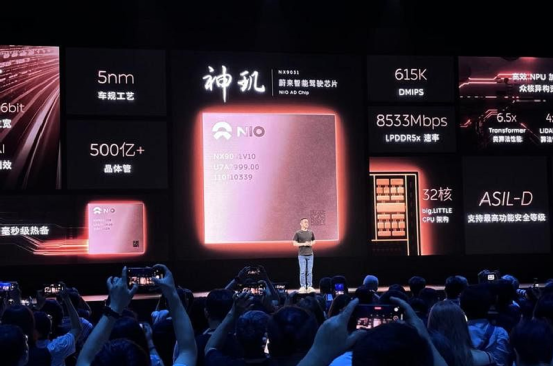

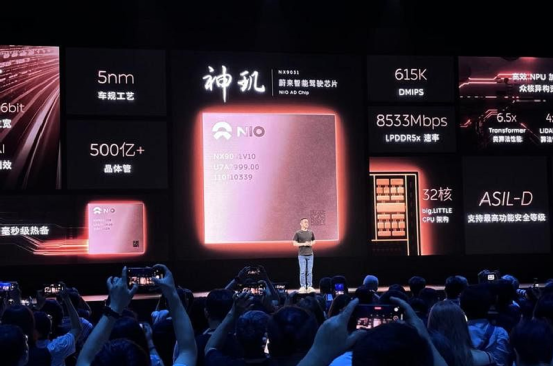

Domestic intelligent driving chip, really stand up? IN the recent two months, in the field of intelligent driving chips, domestic car companies can be described as "frequent events", at the end of July, on the "NIO IN 2024 NIO Innovation and Technology Day", NIO announced the first car level 5nm intelligent driving chip "Shenji NX9031" successful stream. According to the parameters announced by NIO, Shenguet NX9031 has more than 50 billion transistors. The computing power is said to reach four Nvidia Orin X chips (254 Tops each), which is about 1,000 Tops.

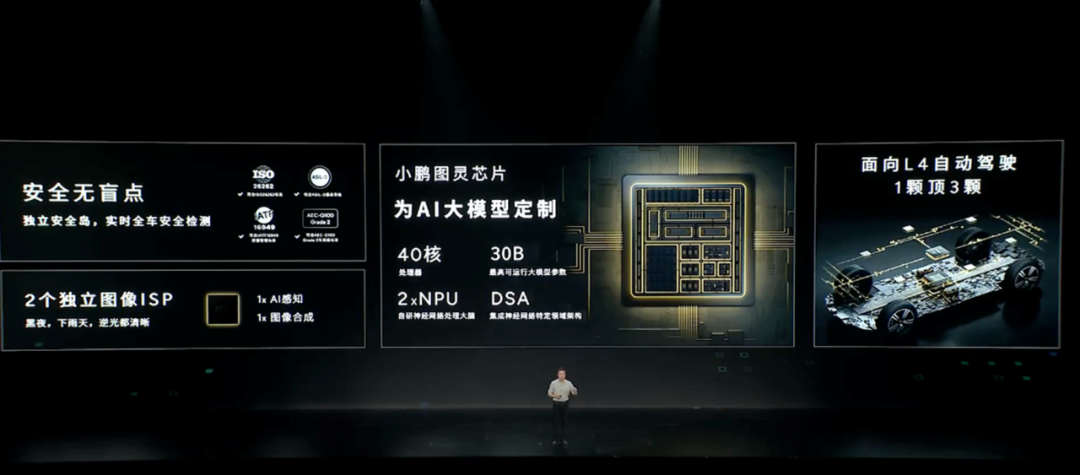

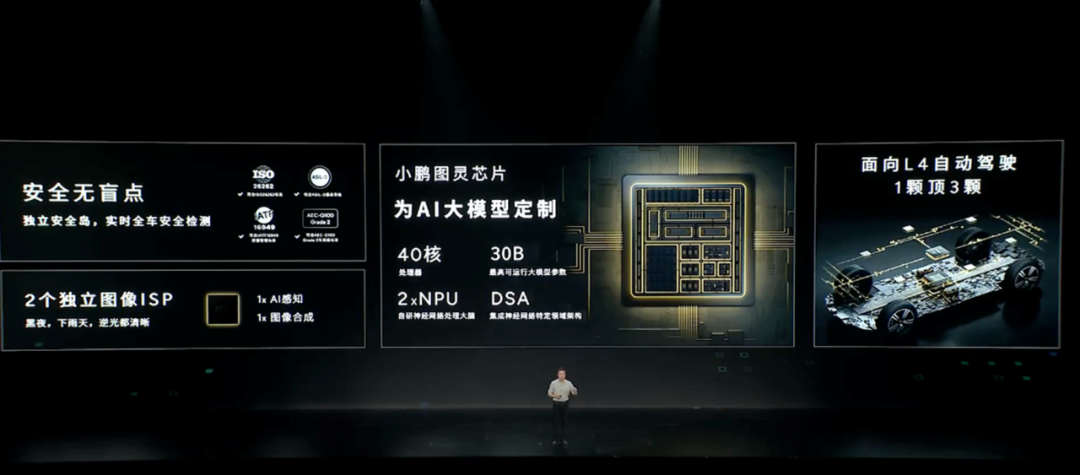

Similarly, on the evening of August 27, He Xiaopeng, chairman and CEO of Xiaopeng Automobile, announced that the Turing chip, an intelligent driving chip independently designed by Xiaopeng, was successfully streamed on August 23, and the Turing chip can be used for L4 automatic driving. According to the information released by Xopeng, this Turing chip has 40 core cpus, two Npus, and two independent image ISPs. At the same time, it can also support large models with 30 billion parameters to run on the end side.

He Xiaopeng claims that when applied to L4 autonomous vehicles, a Turing chip is comparable to the current three mainstream intelligent driving chips. In addition, there is news that ideal has also begun to make efforts in self-developed intelligent driving chips, and its self-developed intelligent driving chip project is code-named "Schumacher" and will complete the flow sheet within the year. So, with such a "strong emergence" situation, some readers ask: Does this mean that domestic car companies really want to subvert the traditional overlords in the field of intelligent driving? In this article today, I will talk with you about domestic alternatives in the field of intelligent driving chips.

Smart drive chip cake

In the circle of intelligent driving chips, Nvidia is definitely the boss. According to the data of the Geishi Automotive Research Institute, in the installed capacity of intelligent driving chips in the Chinese market in 2023, Tesla's FSD chip ranked first, selling about 1.208 million pieces, accounting for 37% of the market share; Nvidia's Orin-X chip was a close second, selling 1.095 million units, or 33.5 percent; The domestic Horizon Journey 5 chip ranked third, selling 200,000, the market share is 6.1%. This shows that it is not easy to take cake from the table of giants. With the super computing power of Orin-X single 254TOPS, for a long time, NVIDIA has been difficult to match in the field of intelligent driving chips.

Such a pattern, so that any car companies that want to enter the field of intelligent driving have to see the face of Nvidia. For example, according to the data of the high-tech Intelligent Automobile Research Institute, in 2023 alone, NiO, Xiaopeng and Ideal will contribute nearly 90% of the pre-installation share of NVIDIA Orin chips in the Chinese market. So the question is, why is Nvidia so strong in the field of intelligent driving chips? In the view of the old bureau, in addition to its strong computing power as a hard power, its biggest advantage is constantly updated products and a complete hardware and software ecosystem. Specifically, Nvidia not only sells chips, but also provides a complete set of autonomous driving solutions - the Drive AGX platform, which includes hardware, software, algorithms, and development tools. Drive AGX also includes the Drive OS operating system, CUDA and TensorRT development frameworks.

In this way, car companies and developers can easily build and optimize intelligent driving algorithms and shorten the development cycle. Simply put, it is the use of Nvidia chips, convenient and flexible. This kind of software and hardware one-stop service, from the chip to the development platform to give you a round. Nvidia directly gives car companies a set of "fool version" tools, and it's done. The development cycle? It gets shorter with a little rub. What's even better is the modular design. L2, L3 level, a piece of done; If you want to L4 and L5, it can also be solved by dual chip or multi-chip, which means that car companies can use the same hardware platform to produce different levels of automatic driving systems. Go low, go high, go how you want.

More importantly, this dual-chip, multi-chip configuration is not only a simple hardware stack, but intelligent management through software, and scheduling tasks and data communication between multi-chips. In one sentence, it is concluded that Nvidia's strength lies not only in its hardware, but through the complete ecology, the road to be taken by car companies in intelligent driving and the obstacles to be crossed have been flattened in advance. Such experience and effect, so that a lot of car companies all feel very smooth. In the field of intelligent driving, Tesla and the new domestic forces at the beginning of the preferred chip supplier is the earlier Mobileye, but because its ecology is relatively closed with Nvidia, and in flexibility and overall performance scalability is not as good as Nvidia, and later went the traditional supplier's "black box model", that is, what is inside the box and how it works are trade secrets. This is undoubtedly difficult for some large car companies to accept.

Therefore, even in the case of similar computing power, many high-class intelligent driving models will still choose Nvidia as a supplier. Since it is well used, why do domestic car companies have to gnaw on this hard bone and pursue self-research?

The necessity of self-research

Nvidia's chips are really good in the field of intelligent driving, and the market penetration is high, but the price, TSK, TSK, is painful. In 2022, Nvidia Orin chips will be listed at a price between $400-500 (about 3,000 yuan). If a car uses two Nvidia Orin-X chips, the cost of the main computer chip of its intelligent driving system will reach more than 6,000 yuan. What's more painful is that those car companies, for every one more piece of Orin-X, the price of selling to consumers will be 20,000 more! Domestic car companies, as well as our consumers, are called a miserable Nvidia! Moreover, now the new energy vehicle industry, that is called an internal volume! Car companies require L2+ autonomous driving programs to further reduce prices in the future, and chip companies' cost control capabilities should be stronger.

On the other hand, the complexity of the autonomous driving algorithm will require the chip computing power to continue to rise. Under the overall, a chip that can support Transformer's efficient operation, price and advantage, that is the real ability! And, more importantly, if the car company does not have the self-research ability at the hardware and software level, it means that the "product definition right" of the car company is still in the hands of the chip supplier. Such a "right to definition" depends to a large extent on whether the car company has a deep customization and full autonomy and control ability. On the circuit of intelligent driving chips, now those players who have achieved self-research, such as Tesla and Huawei, have all made great efforts at the software, algorithm and hardware level, forming their own unique advantages. While NVIDIA's NVIDIA DRIVE platform offers an open software ecosystem, at the end of the day, it's a relatively generic solution. Take Tesla, its FSD autonomous driving software is already the industry leader, but without vertical integration from hardware to software, those specific algorithm requirements in FSD, such as end-to-end neural network reasoning, can not be tailored to their own workload, and can not talk about optimizing performance and energy efficiency. In the same way, Huawei's MDC platform is not just an autonomous driving solution, it also integrates Huawei's technical advantages in communications, cloud computing, vehicle and road collaboration (V2X) and operating systems (such as HarmonyOS), which truly forms a full range of competitive barriers.

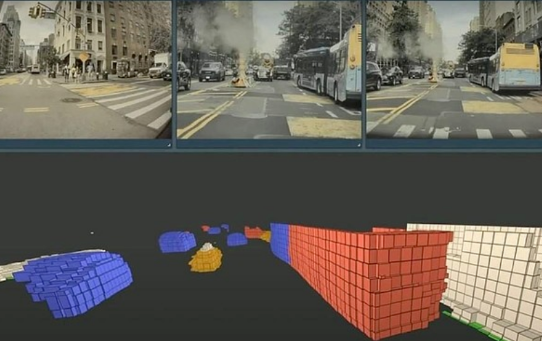

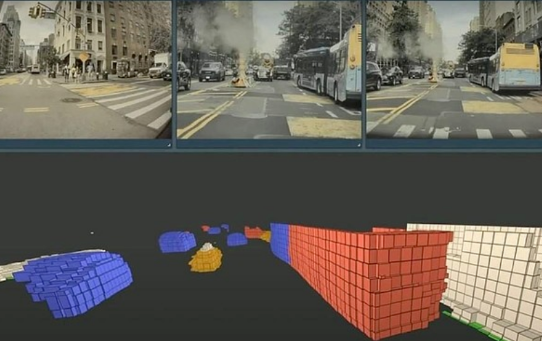

This highly integrated and integrated feature of hardware and software largely defines and distinguishes the brand status of the two in many automobile companies today. More importantly, although the self-developed chip is ostensibly "repeating the wheel", today's automatic driving is a multi-disciplinary and highly complex technology, and no single solution can fully adapt to all situations, such as Tesla's FSD, which is a pure visual perception system. Its AI algorithm relies on the processing and fusion of large amounts of camera data. Therefore, its FSD chip is also bound to be developed in the direction of optimizing the data transmission and processing path in order to reduce latency.

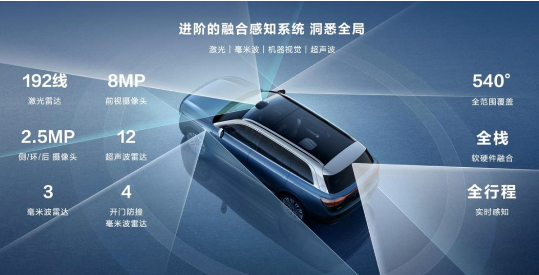

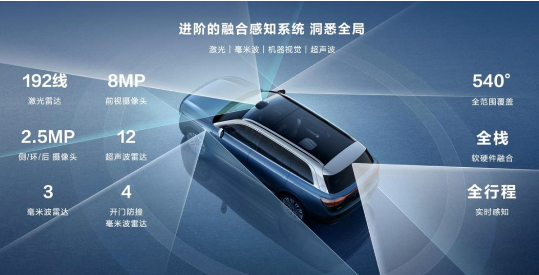

Huawei's MDC platform is the main multi-sensor fusion solution, through cameras, radar, laser radar (LiDAR), high-precision map and V2X (vehicle and road cooperation) and other sensing means to achieve a higher level of autonomous driving. Such a solution requires the chip to support more complex sensor interfaces, data processing pipelines, and fusion algorithms. Different intelligent driving schemes determine different algorithms, different algorithms, and create different chips. Through self-developed chips, various car companies can explore different technical routes and architectures, and constantly verify and optimize them in market competition and practical applications, so that the best solutions and standards gradually emerge.

An opportunity for a counterattacker

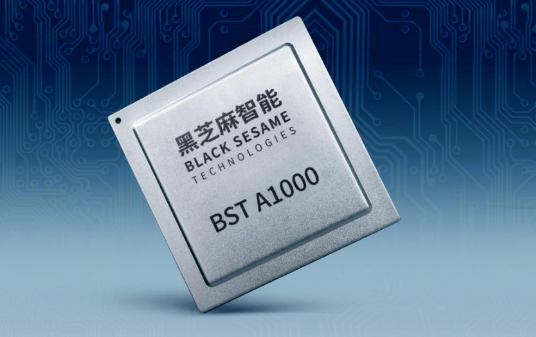

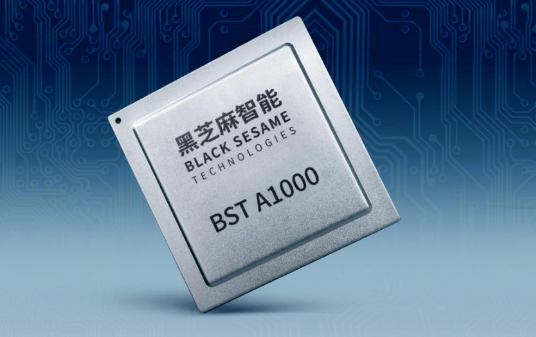

Since self-developed chips are so important, what is the current situation of domestic manufacturers in this regard? At this stage, China has emerged such as Black Sesame, Horizon such more representative intelligent driving chip enterprises, and various new forces, such as Wei Xiaoli, have also begun to enter the self-research chip track, but on the road to self-research, domestic manufacturers still have two major difficulties to break through: One is that the research and development of intelligent driving chips is a project that requires a lot of cross-domain knowledge and talents, and long-term, high-cost investment, which involves computer architecture, AI algorithms, automotive electronics, etc., if it is not a "complex" enterprise with a huge volume and a wide business layout, it wants to handle so many fields on its own. And can also withstand the early high investment and long-term losses, this is a very difficult thing. Look at those self-developed smart driving chips on the market now, but also can stand the big players, Tesla, Nvidia, Huawei these, which is not the multi-perch development of the "compound empire"? They are not just engaged in cars, semiconductors or AI, every field can play, this is the confidence that people can hold.

The advantage of this "composite empire" is that while integrating the advantages of various technologies (semiconductors, automobiles, and AI), it also spreads the risk of high investment in the chip field through a huge territory, which is unreach for intelligent driving chip companies with single revenue structure and limited shipments and traditional car companies. For example, Nvidia in the fourth quarter of 2023, total revenue of $22.1 billion, a 76.7% profit margin; At the same time, revenue from the automotive business was only $281 million, a very low overall share (less than 1.5%). In contrast, in 2023, the shipment of Black sesame Zhihuashan A1000 series SoC was about 127,000 pieces. The entire 2023, black sesame intelligent operating loss of 1.697 billion, rough calculation, the average sold a chip, black sesame intelligent loss of about 13,400 yuan.

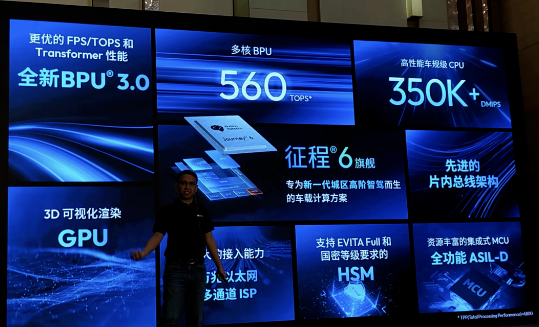

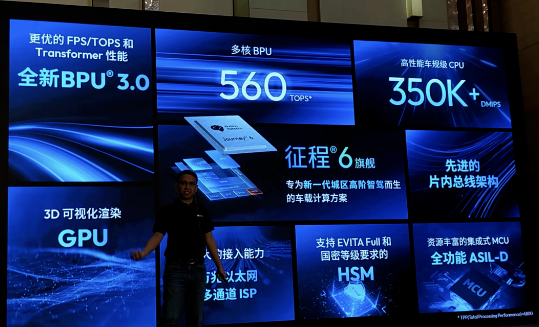

In addition to cross-field, high-investment challenges, another major difficulty for intelligent driving chips is the ability of algorithm optimization and vehicle hardware and software collaboration. This is a test of the chip manufacturers or car companies "internal work" place. Because from the point of view of pure computing power indicators, it is not difficult to surpass Nvidia's Orin-X chip, in fact, there are domestic manufacturers to do this. For example, the Journey 6 series that Horizon completed last year, the most powerful J6P, can reach 560 TOPS. Once this number came out, the computing power of Nvidia's strongest Orin-X chip, 254 TOPS, suddenly seemed insufficient. However, in the field of intelligent driving, just high computing power is not enough, you have to find a way to use this strength to the blade, which is the test of hardware and software cooperation.

The optimization on the software determines whether the chip can deeply customize the algorithm according to the characteristics of its own model and driving scenario, so as to maximize the chip performance and ensure the seamless connection between the chip and the vehicle system. Nvidia has a long history of doing this. Like its self-driving software stack - there's perception, map building, path planning, control, you name it. Not only can it bring together data from various sensors, but it also comes with a bunch of advanced driver assistance and autonomous driving. This modular design gives car companies great flexibility, want to change something according to their own hardware, that is called a handy. To use a metaphor to describe, the intelligent driving chip itself is equivalent to a variety of high-end kitchen utensils in the kitchen (such as multi-functional ovens, induction stoves), while the software ecology and algorithm optimization are equivalent to a rich set of recipes. But fortunately, even in such an extremely tested "internal work" field, domestic manufacturers have also made breakthroughs.