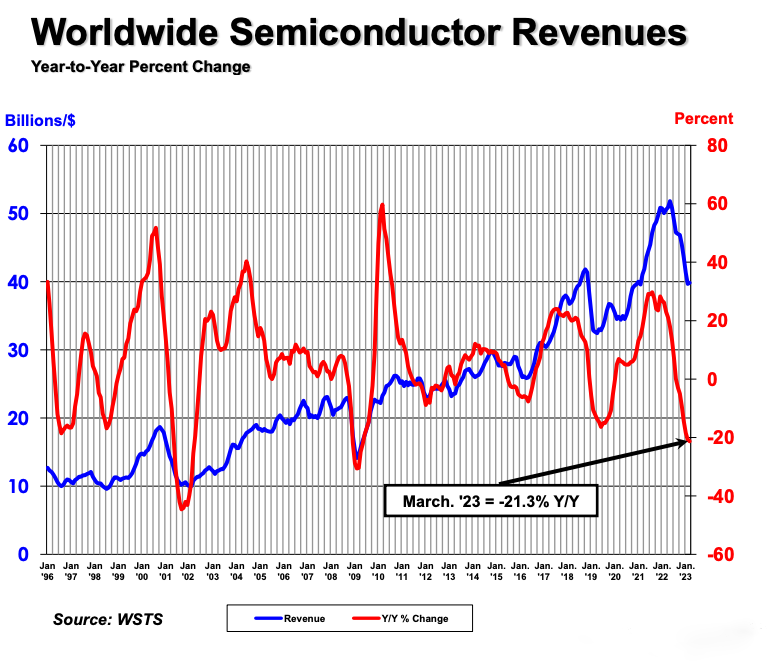

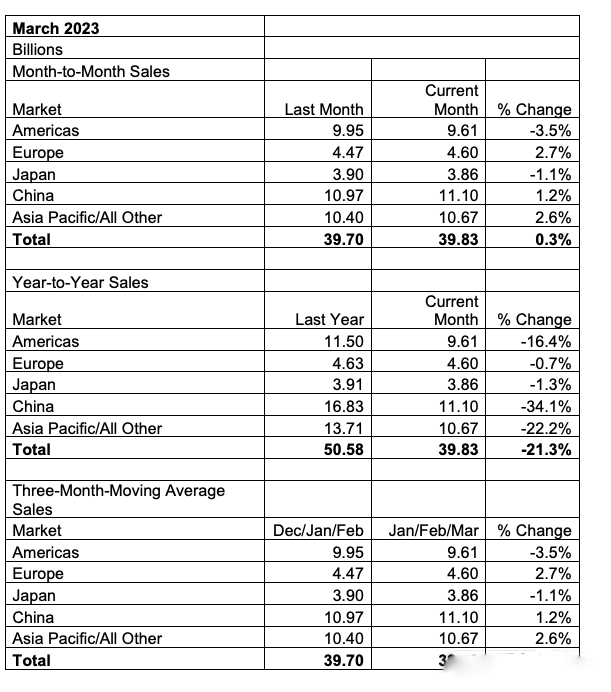

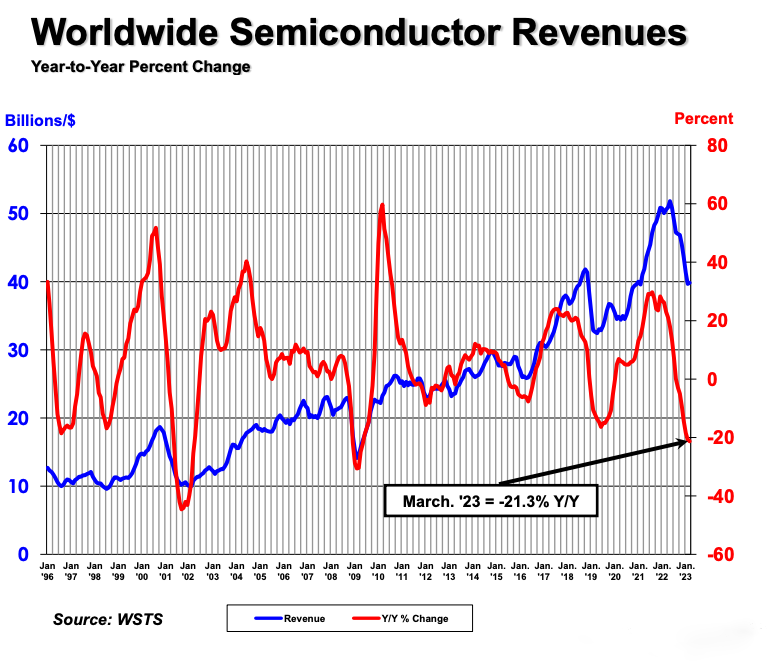

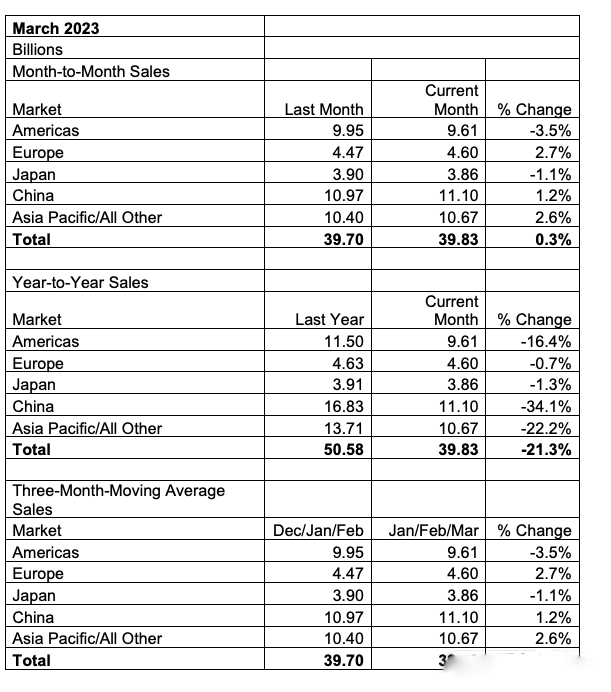

The Semiconductor Industry Association (SIA) announced today that global semiconductor sales in the first quarter of 2023 totaled $119.5 billion, down 8.7% compared to the fourth quarter of 2022 and 21.3% compared to the first quarter of 2022. Sales increased 0.3% in March 2023 compared to February 2023.

"Semiconductor sales continued to decline in the first quarter of 2023 due to market cyclicality and macroeconomic headwinds, but monthly sales rose in March for the first time in nearly a year, providing optimism for a rebound in the months ahead," said SIA President and CEO John Neuffer.

On a regional basis, monthly sales increased in Europe (2.7%), Asia Pacific/All Other Regions (2.6%) and China (1.2%), but declined in Japan (-1.1%) and the Americas (-3.5%). All sales fell, Europe (0.7%), Japan (1.3%), the americas (16.4%), the asia-pacific region/all other (22.2%) and China (34.1%)).

In the first quarter, China's integrated circuit exports fell 22.9% year-on-year

According to the statistics of the General Administration of Customs, in the first quarter of 2023, China's chip imports fell by 22.9% year-on-year, and the total number of imported integrated circuits was 108.2 billion. Imports totaled $78.5 billion, down 26.7 percent from $107.1 billion in the same period last year. China's IC exports fell 13.5% year on year to 60.9 billion pieces, and total exports fell 17.6% year on year.

China's integrated circuit exports were $31.73 billion, down 17.6% year-on-year, but 45.1% higher than the same period in 2019 before the epidemic; Exports fell 13.5% year on year to 60.91 billion, the sixth consecutive quarter of year-on-year decline. Affected by the impact of enterprises to start grabbing orders after the Spring Festival, the decline in integrated circuit exports narrowed in March, down 2.9% year-on-year to 13.1 billion US dollars, a year-on-year decline for nine consecutive months. China is the largest production, export and consumer of electronic information technology products, such products exports are mainly affected by macroeconomic, downstream consumer electronics industry demand.

The chip giant is struggling

By the end of last year, it was clear that the semiconductor industry was heading for a downturn. Three years of runaway demand and tight output are coming to an end, and as the global economy hits the brakes, companies across the supply chain are suddenly saddled with too much inventory. Bottoming has been tough, and the timing of a rebound can have a multibillion-dollar impact.

Taiwan Integrated Circuit Manufacturing in January forecast first-quarter revenue below analysts' expectations, with Chief Executive CC Wei saying demand was "weaker than we thought three months ago." He went on to note that the world's most valuable chipmaker expects "the semiconductor cycle to bottom out sometime in the first half of 2023 and see a healthy recovery in the second half of this year."

In the same month, Samsung Electronics Co observed a "significant deterioration in the business environment in the fourth quarter" and predicted "continued weakness in the short term," followed by the same timeline for a rebound.

In the United States, Texas Instruments, which designs and manufactures its own chips and is widely involved in the electronics industry, offers a revenue outlook almost as disappointing as TSMC's. Dave Pahl, head of investor relations, noted that "when customers start to reduce inventory, it's not a first-quarter phenomenon." Intel is clear about the scale: "We expect the first quarter to be the largest decline in customer inventory we've seen in recent history."

Then in April, they release first-quarter results or second-quarter outlooks that somehow disappoint already depressed expectations. Most troubling is their failure to cut inventories, as overhang is a key reason for these gloomy forecasts. Intel, for example, provided revenue guidance ahead of analysts' forecasts, but it was still down sharply from a year ago, and its own forecast for losses beat expectations. Its inventory levels are higher than a year ago.

Add to that a smoother recovery in end-demand from China's reopening, and the bad news that many hope is now behind us continues. While we're only focusing on four specific companies here, the overall trend persists across the industry, with only a few outliers.

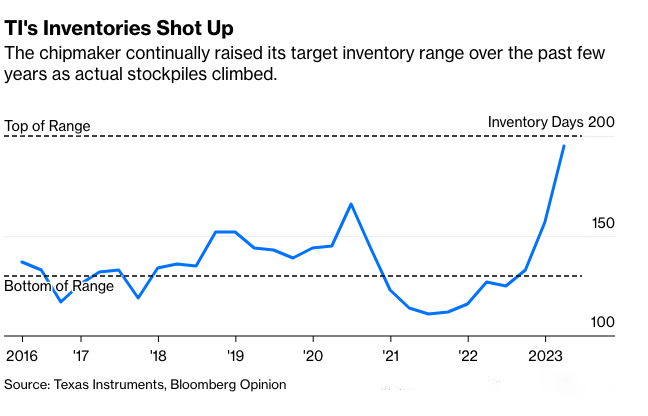

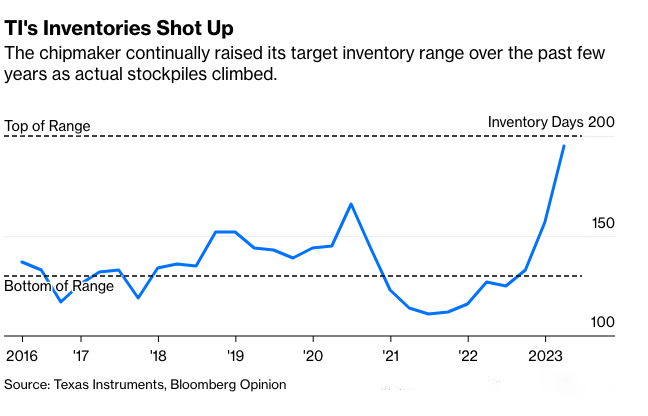

Texas Instruments, for example, saw its inventory climb to 195 days of inventory. That's an amazing 6.5 months.

In an investor call last week, management downplayed that figure, saying the ideal level is 130 to 200 days of inventory. The Dallas-based chipmaker has experienced some range expansion over the past six years. As recently as 2018, it said the goal was 115 to 145 days, but that number has gradually risen as the number of actual shelves has increased. Shortages and logistical problems over the past three years justify at least some of the increases, but they can't hide the fact that it now has a record $3.3 billion in inventory amid the biggest recession in a decade.

Intel's view of the market highlights the uncertainty. After more than a year of declining sales to PC makers, the California company thinks the decline may end soon. But in servers and networks, where the most powerful and expensive chips are sold, worse is yet to come. Overall, that represents a 22 percent decline in the second quarter, and analysts don't expect any growth in the third quarter. That makes it hard to judge the bottom right now.

Samsung saw a slight uptick in memory shipments in the current quarter compared to the March quarter, but declined to provide annual guidance because the outlook was too bleak. Its Taiwanese rival is more confident: "We believe we are passing the bottom of TSMC's business cycle in the second quarter." TI refuses to try: "We don't try to predict where the bottom or top is."

Despite all the uncertainty, chipmakers have been reluctant to cut capital spending budgets. The strategy appears to be based on ensuring that there is enough capacity on hand in the future when consumers and businesses start buying smartphones, servers, PCS and game consoles again.

But it is an expensive bet. The price of these instruments is depreciated in the income statement and is usually the largest single item in the cost of goods sold. In past periods of weakness, manufacturers typically delayed delivery of the equipment they ordered to delay installation and control how long those costs impacted earnings. But as equipment supplies continue to be tight, they may be reluctant to cancel or postpone, preferring to risk slim margins rather than miss customers' orders.

For now, that's not a problem. A delay of a quarter or two, especially during the industry's off-season, won't hurt much. But if we see that end demand fails to materialise in the coming months and inventories remain high in the second half of the year, then those who take drastic action quickest will reap the greatest rewards.

Gartner predicts that global semiconductor revenue will decline by 11%、

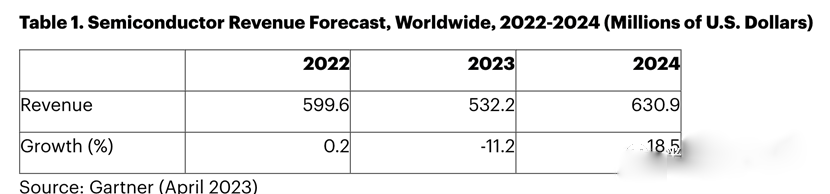

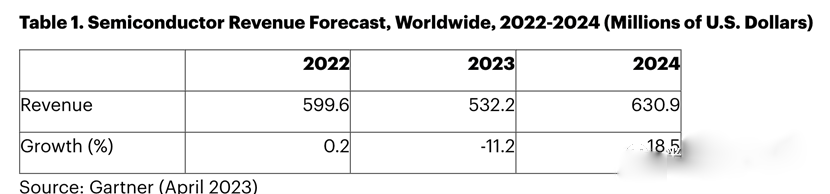

According to the latest forecast from Gartner, Inc., global semiconductor revenue is expected to decline by 11.2% in 2023. By 2022, the total market will reach $599.6 billion, a marginal increase of 0.2% over 2021.

The short-term outlook for the semiconductor market has deteriorated further. Total global semiconductor revenues are expected to reach $532 billion in 2023 (see Table 1).

"As economic headwinds continue, weak end-market electronics demand is spreading from consumers to businesses, creating an uncertain investment environment. In addition, chip oversupply, resulting in increased inventory and lower chip prices, is accelerating the decline in the semiconductor market this year, "said Richard Gordon, practice vice president at Gartner.

Memory revenue will decline by 35.5% in 2023

The memory industry is dealing with overcapacity and excess inventory, which will continue to put significant pressure on average selling prices (ASPs) through 2023. The memory market is expected to total $92.3 billion, declining 35.5% by 2023. However, it is expected to rebound by 70 percent in 2024.

Despite flat bit production from DRAM vendors, the DRAM market will be heavily oversupplied for most of 2023 due to weak end-device demand and high inventory levels. Gartner analysts expect DRAM revenue to decline 39.4 percent to $47.6 billion in 2023. The market will shift to undersupply in 2024, with DRAM revenue growing 86.8% as prices rebound.

Over the next six months, Gartner expects the dynamics of the NAND market to be similar to the DRAM market. Weak demand and large supplier inventories will create oversupply, causing prices to fall sharply. As a result, NAND revenue is expected to decline 32.9% to $38.9 billion by 2023. By 2024, NAND revenue is expected to grow 60.7% due to a severe shortage of supply.

"The semiconductor industry faces a number of long-term challenges over the next decade," Gordon said. "The high-volume, high-value content market drivers of the past few decades are coming to an end, especially in the PC, tablet and smartphone markets where technological innovation is lacking."

Fragmentation of semiconductor demand

The market for semiconductors for PCS, tablets and smartphones is stagnant. By 2023, the combined market will account for 31% of semiconductor revenue, totaling $167.6 billion. "These high-volume markets have become saturated and become alternative markets that lack compelling technological innovation," Gordon said.

At the same time, the automotive and industrial, military/civil aerospace semiconductor markets will grow. The automotive semiconductor market is expected to grow 13.8% to reach $76.9 billion by 2023.

In the future, there will be more but smaller end markets. The end market will be more fragmented, with growth coming from a number of different sectors such as automotive, industrial, iot and military/aerospace.

"End-market demand is less influenced by consumer discretionary spending and more influenced by business capital spending. Supply chains will be more complex, involving more intermediaries and different market channels, and different types of capabilities will be required in order to meet different end-market needs, "Gordon said.

Semiconductor recovery is not as good as expected

Following TSMC's downward revision of the annual semiconductor business outlook, UMC general Manager Wang Shi yesterday also revised down the annual semiconductor industry outlook proposed earlier, predicting that the overall semiconductor business (excluding memory) from the original estimate to decline by a low single digit (1~3%), down to about a mid-single digit recession (4~6%); The foundry industry decreased by mid-single digits (4-6%) and was also revised down to a high-single digit decline (7-9%).

Wang Shi stressed that the economy was expected to recover in the second half of the year, but so far, there is no sign of a strong recovery, and the industrial inventory is slower than expected. Wang Shi admitted that the industry recovery is slower than originally expected, the overall demand outlook for the quarter is still sluggish, and customers are expected to continue to adjust inventories, "this year is a challenging year."

Wang did not hesitate to point out that the industry recovery has been slower than originally expected, including consumer electronics, computers, communications and automotive applications are expected to stabilize this quarter, but there are no signs of a strong recovery in demand in the coming months, but automotive and industrial orders remain high.

The market is concerned about the trend of the mature process of wafer foundry quotation and UMC's follow-up pricing strategy, Wang Shi stressed that in the face of challenges, UMC is not only focused on price, but also provides customer technology and capacity support, and the average unit price of products this season will remain stable.

For the whole year, Wang Shi admitted that this year is a challenging year, with the market recovery slower than expected, UMC lowered this year's global semiconductor and wafer foundry industry revenue forecast, expected semiconductor industry revenue will be reduced by 4% to 6%, the reduction is higher than the original estimate of 1% to 3%; Foundry revenue will decline 7 percent to 9 percent annually, wider than the original estimate of 4 percent to 6 percent.

Wang Shi stressed that even if the main terminal market demand is weak, UMC's automotive and industrial products continue to grow, especially the automotive business revenue contribution of 17% in the first quarter, under the automobile electronic and automatic driving drive, looking forward to the automotive IC content continues to increase, automotive products will be an important source of revenue and growth of the company in the future. Umc will simultaneously strengthen long-term cooperation with key automotive customers.

Even if market conditions do not develop as expected, UMC still estimates that there is a chance that operations will bottom out in the first quarter, and that conditions for the 22nm and 28nm processes should improve in the coming months, driven by the expected stabilization of consumer, communications and automotive demand, as well as OLED driver ics, digital TVS and WiFi. However, we are confident that the capacity utilization rate driven by the above applications is expected to increase quarter by quarter and strive to reach about 80%.

Looking ahead, UMC stressed that it will continue to focus on differentiated solutions across logical and special process platforms, such as eHV, RFSOI, and BCD, to enhance future business growth and expand its presence in the semiconductor industry.

On the other hand, with the opening of the new capacity of the Nanke Fab 12A plant, UMC's second quarter wafer production capacity is estimated to reach 2.63 million 8-inch wafers, an increase of 4.12% quarter-on-quarter and 3.88% year-on-year.

When it comes to whether geopolitics affects customers' assessment of supply chain stability, UMC explained that the company has production bases in mainland China, Taiwan, Singapore and Japan, and has diversified and decentralized production capacity advantages, and can have more choices in cooperation with customers.

Automotive semiconductors will also crash?

After TSMC said it would release the information that the outlook was not as good as expected, Morgan Stanley (Morgan Stanley) Securities' latest report pointed out that the downside risk of the automotive semiconductor boom increased, especially the weak demand for automotive MOSFET, the loss of pricing power of automotive power management IC plants, and the related Taiwan plants such as silicon power and syncrystal, respectively, gave "worse than the market" and "neutral" ratings.

The outlook for the automotive sector is volatile, and technology companies have recently issued expectations of weakening demand. Such as the production of automotive microcontrollers (MCUS), TSMC, which is based on the 65 nanometer process, admitted in the French conference recently that the demand for automotive semiconductors is currently stable, but it will weaken in the second half of the year.

LMC also said that demand for automotive MOSFETs and insulated gate bipolar transistors (IGBTs) is declining. Hycrystal, which makes 56% of its revenue contribution from auto-related products (mainly MOSFETs), said that global integrated component plant (IDM) customers' demand in the second half of this year will be the same as in the first half, indicating that the economic recovery in the second half of the year is relatively limited.

After an industry visit, Momo pointed out that the supply of automotive MOSFET is no longer tight, and worse, the demand is also weakening. He Jing also believes that some businesses face headwinds, and the recovery in the second half of the year is limited; On the other hand, the automotive power management IC and analog IC industry also continues to face downward price pressure.

Fortunately, not all auto subindustries are pessimistic. From the supply chain, power solution suppliers believe that automakers are still signing memorandums of understanding (Mous) with IGBT suppliers for 2024, because IGBT demand for inverters remains stable, and some customers are even still asking for a 30% to 50% increase in IGBT supply in 2024 compared to the current level.

In addition to the high demand for automotive IGBT, automotive MCU is also a tight part of the demand, and the current automotive MCU has not yet declined in terms of consumption and price.